Are you curious about the annual salary for a position that pays $27.50 per hour? Understanding the yearly compensation associated with an hourly wage is crucial for financial planning and career advancement. Whether you're an employer or an employee, calculating the annual salary from an hourly rate is essential for budgeting, salary negotiations, and assessing job opportunities.

To determine the annual salary for a $27.50 hourly wage, we need to consider the number of hours worked per year. Assuming a standard full-time schedule of 40 hours per week, we can calculate the annual salary as follows: 27.50 (hourly wage) x 40 (hours per week) x 52 (weeks in a year) = $57,200. This means that an individual earning $27.50 per hour would receive an annual salary of $57,200, assuming full-time employment with no overtime or additional hours worked.

What Is 27.50 An Hour Annually?

When calculating the annual salary of an employee who earns $27.50 per hour, there are a few factors to consider: the number of hours worked per week, the number of weeks worked per year, and any potential overtime pay or bonuses. Assuming a standard 40-hour workweek and 52 weeks worked per year, the annual salary would be calculated as follows:

Annual Salary = Hourly Wage * Hours Worked per Week * Weeks Worked per Year

Annual Salary = $27.50 * 40 hours * 52 weeks

Annual Salary = $57,200

Therefore, an employee who earns $27.50 per hour would have an annual salary of $57,200 assuming they work a standard 40-hour workweek and 52 weeks per year.

Factors that can affect annual salary

- Overtime pay: If an employee works more than the standard 40 hours per week, they may be eligible for overtime pay, which is typically paid at a higher rate than their regular hourly wage. This can increase their annual salary.

- Bonuses: Some employers offer bonuses to their employees, which can also increase their annual salary. Bonuses can be based on performance, sales goals, or other factors.

- Number of hours worked: The number of hours worked per week and the number of weeks worked per year can also affect an employee's annual salary. If an employee works more hours or more weeks, their annual salary will be higher.

Hourly Wage to Annual Salary

Knowing your hourly wage is one thing, but knowing how much you make annually is quite another. If you're negotiating a salary or simply want to get a better understanding of your finances, it's important to be able to convert between hourly and annual pay. Here's a quick and easy guide to help you do just that.

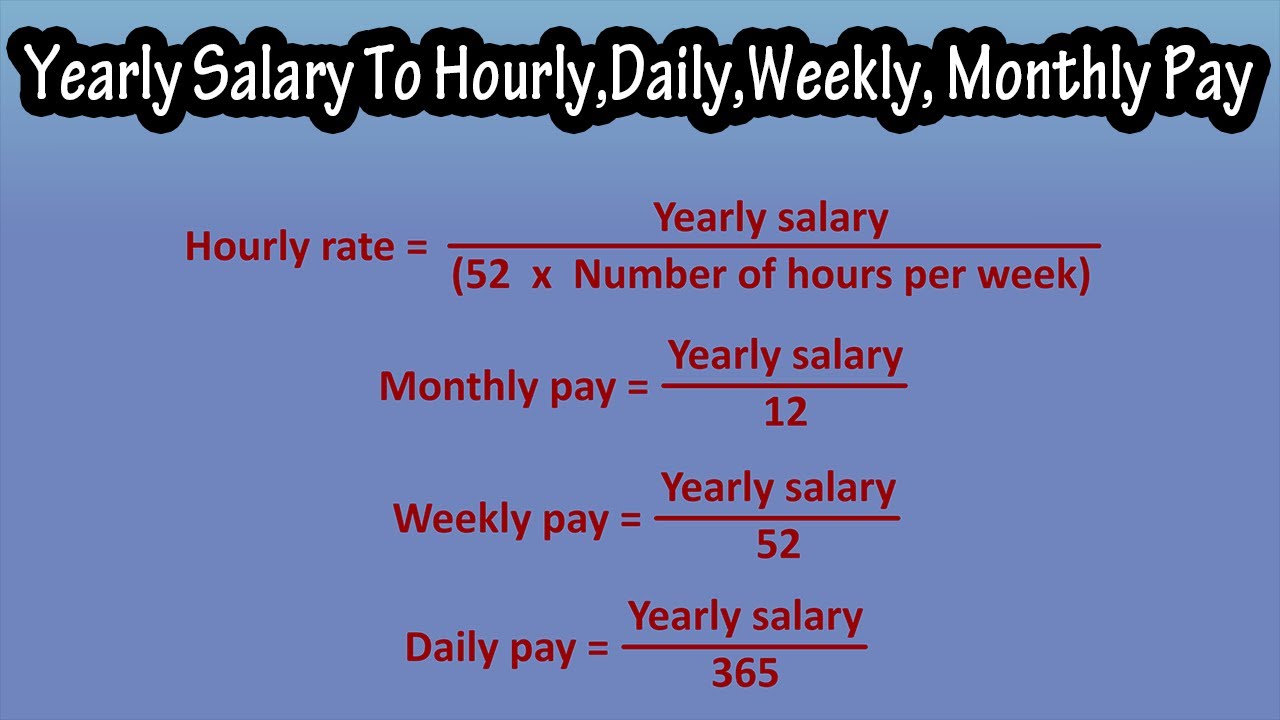

How to Convert Hourly Wage to Annual Salary

To convert your hourly wage to an annual salary, you need to know how many hours you work per year. Once you have that number, you can simply multiply your hourly wage by the number of hours to get your annual salary.

For example, if you make $27.50 per hour and work 40 hours per week, your annual salary would be $27.50 x 52 weeks x 40 hours = $57,200.

Factors That Can Affect Your Annual Salary

In addition to your hourly wage, there are a number of other factors that can affect your annual salary, including:

- Overtime pay: If you work more than 40 hours per week, you may be eligible for overtime pay. This can significantly increase your annual salary.

- Benefits: Many employers offer benefits such as health insurance, paid time off, and retirement plans. These benefits can add to your overall compensation package and increase your annual salary.

- Taxes: Taxes are deducted from your paycheck before you receive it. The amount of taxes you pay depends on your income, filing status, and other factors. Taxes can reduce your annual salary.

Conclusion

Converting your hourly wage to an annual salary is a simple process. By understanding the factors that can affect your annual salary, you can negotiate a salary that is fair and appropriate for your experience and skills.

What Is 27.50 An Hour Annually?

To calculate your annual salary from an hourly wage of $27.50, you need to multiply your hourly rate by the number of hours worked in a year. Here's how to do it:

- Step 1: Determine the number of hours worked in a year.

There are approximately 2,080 working hours in a year, calculated as 40 hours per week multiplied by 52 weeks.

- Step 2: Multiply your hourly rate by the number of hours worked.

Hourly Rate x Number of Hours = Annual Salary

$27.50 x 2,080 hours = $57,200

Therefore, an hourly wage of $27.50 translates to an annual salary of $57,200.

Monthly Take-Home Pay

To estimate your monthly take-home pay after taxes and other deductions, you can use a net pay calculator or consider the following factors:

- Federal and State Income Taxes: These are taxes withheld from your paycheck based on your income and filing status.

- Social Security Tax (FICA): This is a 6.2% tax that funds Social Security and Medicare programs.

- Other Deductions: This may include health insurance premiums, retirement contributions, or union dues.

On average, these deductions can reduce your take-home pay by 20-30%. Using the annual salary of $57,200 as an example, your estimated monthly take-home pay could be around:

$57,200 / 12 months = $4,766.67

Assuming a 25% deduction rate, your monthly take-home pay would be approximately:

$4,766.67 x 0.75 = $3,575

Please note that this is an estimate, and your actual take-home pay may vary depending on your specific circumstances and deductions.

Tax Implications of Earning $27.50 Per Hour Annually

Earning $27.50 per hour equates to an annual salary of $57,200 before taxes. The amount of taxes you owe will vary depending on several factors, including your filing status, number of dependents, and deductions.

Federal Income Tax

The federal income tax brackets for 2023 are as follows:

| Filing Status | Tax Bracket |

|---|---|

| Single | $0-$11,850: 10% $11,851-$44,725: 12% $44,726-$89,475: 22% $89,476-$178,950: 24% $178,951-$274,650: 32% $274,651-$539,900: 35% $539,901+: 37% |

| Married Filing Jointly | $0-$23,700: 10% $23,701-$89,450: 12% $89,451-$178,900: 22% $178,901-$274,600: 24% $274,601-$428,750: 32% $428,751-$622,050: 35% $622,051+: 37% |

| Married Filing Separately | $0-$11,850: 10% $11,851-$44,725: 12% $44,726-$89,450: 22% $89,451-$178,900: 24% $178,901-$274,600: 32% $274,601-$388,350: 35% $388,351+: 37% |

| Head of Household | $0-$15,500: 10% $15,501-$57,825: 12% $57,826-$89,450: 22% $89,451-$178,900: 24% $178,901-$274,600: 32% $274,601-$428,750: 35% $428,751+: 37% |

Based on the federal income tax brackets, an individual earning $57,200 would fall into the 24% tax bracket.

State and Local Taxes

In addition to federal income tax, you may also be subject to state and local income taxes. The amount of state and local taxes you owe will vary depending on where you live.

For example, if you live in California, you would be subject to a state income tax of 7.25%. This means that you would owe an additional $4,146 in state income taxes.

FICA Taxes

FICA taxes are a combination of Social Security and Medicare taxes. Social Security taxes are used to fund Social Security benefits, while Medicare taxes are used to fund Medicare benefits.

The combined FICA tax rate is 15.3%. This means that you would owe $8,782 in FICA taxes.

Total Taxes

Adding up all of the federal, state, and local taxes, you would owe a total of $13,473 in taxes on an annual salary of $57,200.

This leaves you with a net income of $43,727.

What is $27.50 an Hour Annually?

$27.50 an hour equates to $57,200 annually. This is calculated by multiplying the hourly rate by the number of hours worked in a year. Most full-time employees work 40 hours per week, which equals 2,080 hours per year.

Here is a breakdown of the calculation:

Hourly rate: $27.50

Number of hours worked per week: 40

Number of weeks worked per year: 52

Annual salary: $27.50 x 40 hours/week x 52 weeks/year = $57,200

It is important to note that this is just a general calculation. Your actual annual salary may vary depending on factors such as overtime pay, bonuses, and deductions.

What Is 27.50 An Hour Annually?

With an hourly wage of $27.50, one can calculate their annual salary by multiplying the hourly rate by the number of hours typically worked in a year. Considering full-time employment, around 2,080 hours are worked annually. Using this formula:

Hourly Wage x Annual Hours = Annual Salary

$27.50 x 2,080 hours = $57,200

Thus, an individual earning $27.50 an hour would have an annual salary of $57,200.

Conclusion

In conclusion, the annual salary equivalent of $27.50 per hour depends on the number of hours worked per year. Assuming a standard 40-hour workweek, the annual salary would be $57,200. However, if the individual works more or less than 40 hours per week, the annual salary will be adjusted accordingly. It is important to consider factors such as overtime, vacation time, and sick leave when calculating the annual salary.

Frequently Asked Questions

What is 27.50 an hour annually?

27.50 an hour is equivalent to $57,200 annually, assuming a 40-hour work week and 52 weeks per year.

How much is 27.50 an hour after taxes?

The amount of taxes you pay on $27.50 an hour depends on your filing status, deductions, and tax bracket. However, as a general estimate, you can expect to pay around $7,000-$10,000 in federal income taxes, leaving you with approximately $47,200-$50,200 after taxes.

Is 27.50 an hour a good salary?

Whether or not $27.50 an hour is a good salary depends on several factors, including your location, experience, and the cost of living in your area. In some areas, it may be a comfortable living wage, while in others it may be considered low.

How much is 27.50 an hour bi-weekly?

27.50 an hour is equivalent to $2,200 bi-weekly, assuming a 40-hour work week.

How much is 27.50 an hour semi-monthly?

27.50 an hour is equivalent to $2,360 semi-monthly, assuming a 40-hour work week and 26 pay periods per year.