TIV (Total Insured Value) is a crucial concept in insurance. It represents the total amount of coverage provided by an insurance policy and determines the maximum amount the insurer will pay in the event of a covered loss. TIV is calculated based on the value of the insured property, which can include buildings, contents, inventory, or other assets. Understanding TIV is essential for policyholders to ensure adequate coverage and avoid potential underinsurance issues.

Determining the TIV of a property requires a thorough assessment of its overall value. Factors considered include the market value, replacement cost, and depreciation. In the case of buildings, the TIV may include the structure, fixtures, and any improvements or upgrades made to the property. For contents insurance, the TIV represents the value of the personal belongings or equipment covered by the policy. Accurate TIV calculations help insurers assess the risk and determine appropriate premiums, ensuring a fair and balanced insurance arrangement.

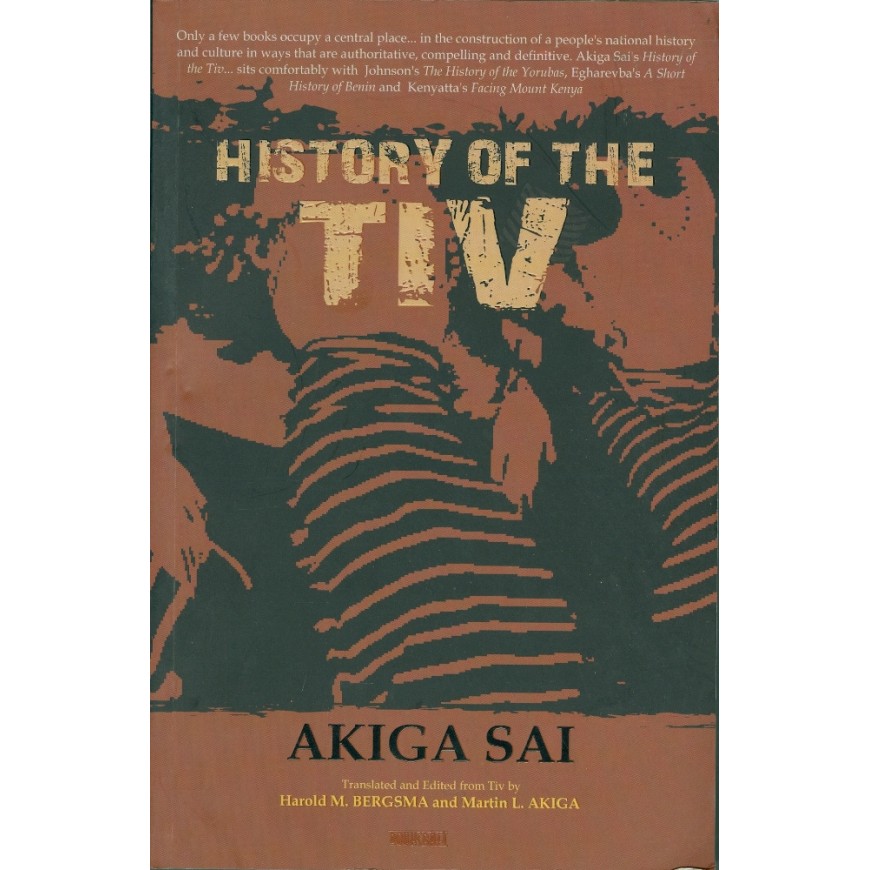

Tiv People

The Tiv are a people who live in central Nigeria. They are the second largest ethnic group in Nigeria, after the Hausa. The Tiv are known for their traditional way of life, which includes farming, hunting, and fishing. They are also known for their strong sense of community and their love of music and dance.

History

The Tiv people originated in the eastern part of the Chad Basin. They migrated to their present location in central Nigeria around the 16th century. The Tiv established a powerful kingdom that was able to resist the expansion of the Fulani empire. In the 19th century, the Tiv came into contact with the British, who colonized Nigeria. The British established a colonial administration in Tivland, which led to significant changes in the traditional way of life.

Culture

The Tiv have a rich and vibrant culture. They are known for their traditional music and dance, which are often performed at festivals and ceremonies. The Tiv are also known for their traditional crafts, such as pottery, weaving, and basketry.

The Tiv have a strong sense of community. They are organized into clans and lineages, which are responsible for providing support and assistance to their members. The Tiv also have a strong tradition of oral history, which is passed down from generation to generation.

Religion

The Tiv are a predominantly Christian people. However, they also practice traditional beliefs, such as the belief in a supreme being called Swem. The Tiv believe that Swem created the world and that he is responsible for the well-being of the people.

Economy

The Tiv economy is based on agriculture. The Tiv are primarily farmers, who grow crops such as yams, cassava, and millet. They also raise livestock, such as cattle, goats, and sheep. The Tiv also practice fishing and hunting.

Challenges

The Tiv people have faced a number of challenges in recent years. These challenges include:

- Poverty: The Tiv are one of the poorest people in Nigeria. They lack access to basic services such as healthcare and education.

- Conflict: The Tiv have been involved in a number of conflicts with other ethnic groups in Nigeria. These conflicts have resulted in the displacement of thousands of people and the destruction of property.

- Climate change: The Tiv are also facing the challenge of climate change. Climate change is causing the weather to become more erratic, which is making it difficult for them to grow crops.

Conclusion

The Tiv people are a proud and resilient people. They have faced a number of challenges in recent years, but they have remained steadfast in their commitment to their culture and their traditions. The Tiv people are a valuable part of the Nigerian mosaic, and they have much to offer the country.

Tiv In Insurance

TIV in insurance stands for Total Insured Value. It is the total amount of coverage that an insurance policy provides for a specific property or asset. The TIV is used to determine the amount of money that the insurance company will pay out in the event of a loss.

The TIV is typically based on the replacement cost of the property or asset. This is the cost of replacing the property or asset with a new one of similar quality and condition. The TIV may also include the cost of any additional expenses that would be incurred as a result of the loss, such as the cost of removing debris or repairing damaged property.

It is important to have the correct TIV for your insurance policy. If the TIV is too low, you may not be able to recover the full cost of replacing your property or asset in the event of a loss. If the TIV is too high, you may be paying for more coverage than you need.

Your insurance agent can help you determine the correct TIV for your insurance policy. They will consider the following factors when determining the TIV:

- The age and condition of the property or asset

- The location of the property or asset

- The type of construction

- The replacement cost of the property or asset

- Any additional expenses that would be incurred as a result of a loss

Once you have determined the correct TIV for your insurance policy, you should review it regularly to make sure that it is still accurate. Your TIV may change over time due to factors such as inflation, renovations, or changes in the value of your property or asset.

Tiv Culture

The Tiv people are an ethnic group native to central Nigeria. They are the fourth largest ethnic group in the country, with a population of over 5 million people. The Tiv language is spoken by over 2 million people worldwide.

The Tiv people have a rich and complex culture, with a long history of agriculture and trade. They are also known for their traditional music and dance. The Tiv people are a proud and independent people, with a strong sense of community.

Tiv Traditional Religion

The Tiv people have a traditional religion that is based on the belief in a supreme being called Aondo. Aondo is believed to be the creator of the universe and the source of all life. The Tiv people believe that Aondo is a benevolent god who watches over them and protects them from harm.

The Tiv people also believe in a number of other gods and spirits. These gods and spirits are believed to control different aspects of life, such as rain, thunder, and fertility. The Tiv people believe that these gods and spirits can be influenced by prayers and sacrifices. They also believe that these gods and spirits can be punished for their actions.

Tiv traditional religion is a vital part of Tiv culture. It is a source of spiritual guidance and support for the Tiv people. Tiv traditional religion also helps to maintain social harmony and order within the Tiv community.

Tiv Music and Dance

The Tiv people have a rich and vibrant musical tradition. They are known for their polyphonic music, which is often sung a cappella. The Tiv people also have a number of traditional dances, which are often performed at festivals and ceremonies.

Tiv music and dance is an important part of Tiv culture. It is a source of entertainment and joy for the Tiv people. Tiv music and dance also helps to maintain social harmony and order within the Tiv community.

Tiv Art and Crafts

The Tiv people are also known for their traditional art and crafts. They make a variety of beautiful and intricate items, including baskets, pottery, and jewelry. The Tiv people also have a tradition of wood carving, and they make a variety of masks and statues.

Tiv art and crafts are an important part of Tiv culture. They are a source of beauty and pride for the Tiv people. Tiv art and crafts also help to maintain social harmony and order within the Tiv community.

Tiv In Insurance

Tiv is an insurance company that offers a wide range of products and services to meet the needs of individuals and businesses. The company was founded in 1991 and is headquartered in Nigeria. Tiv has a strong presence in Africa and has operations in several countries across the continent. The company offers a variety of insurance products, including auto insurance, home insurance, business insurance, and health insurance.

Tiv's Mission

Tiv's mission is to provide affordable and accessible insurance to all. The company believes that everyone deserves to have the peace of mind that comes with knowing that they are financially protected. Tiv is committed to providing its customers with the highest level of customer service and support.

Tiv's Products And Services

Tiv offers a wide range of insurance products and services to meet the needs of individuals and businesses. The company's products include:

- Auto insurance

- Home insurance

- Business insurance

- Health insurance

- Life insurance

- Travel insurance

Tiv also offers a variety of financial services, including:

- Loans

- Investments

- Savings accounts

Tiv's Financial Strength

Tiv is a financially sound company. The company has a strong capital base and a healthy investment portfolio. Tiv is also well-rated by independent rating agencies. This means that the company is able to meet its financial obligations to its policyholders.

Tiv is a leading provider of insurance in Africa. The company is committed to providing its customers with the best possible products and services. Tiv is a reliable and trustworthy partner that can help you protect your financial future.

What Is Tiv In Insurance

TIV stands for Total Insured Value. It refers to the total amount of insurance coverage that is provided for a particular property or asset. The TIV is used to determine the amount of premiums that are due, as well as the amount of coverage that will be provided in the event of a loss.

Calculating TIV

The TIV is typically calculated by taking the current market value of the property or asset and then adding in any applicable sales tax or other fees. The TIV can also include the cost of any improvements or renovations that have been made to the property or asset.

Importance of TIV

It is important to have the correct TIV for your insurance policy. If the TIV is too low, you may not have enough coverage to fully replace your property or asset in the event of a loss. If the TIV is too high, you may be paying more for insurance than you need to.

How to Determine TIV

There are a few different ways to determine the TIV for your property or asset. One way is to get an appraisal from a qualified professional. Another way is to use an online valuation tool. You can also use the TIV calculator that is provided by your insurance company.

Updating TIV

The TIV for your property or asset should be updated periodically to reflect any changes in the market value or any improvements that have been made. You should also update the TIV if you make any changes to your insurance coverage.

Conclusion

TIV is an essential component of any insurance policy. It ensures that the insured has sufficient coverage to replace or repair their property in the event of a loss. By understanding TIV, policyholders can make sure that they are adequately protected and avoid financial hardship in the aftermath of a disaster.

Frequently Asked Questions

What is TIV in insurance?

Total Insured Value (TIV) represents the total amount of insurance coverage for your personal property and belongings. It is used to determine the maximum amount your insurance company will pay out in the event of a covered loss.

Why is it important to have the correct TIV?

Having the correct TIV is crucial to ensure you have adequate coverage for your belongings. If your TIV is too low, you may be underinsured and face financial losses if your belongings are damaged or destroyed. Conversely, if your TIV is too high, you may be paying for unnecessary coverage and wasting money on premiums.

How do I determine the correct TIV for my insurance policy?

To determine the correct TIV, create an inventory of all your personal belongings, including the estimated value of each item. Consider factors like age, condition, and replacement cost. You can also consult with an insurance agent or appraiser for assistance in estimating the value of your belongings.

What happens if I have a covered loss and my TIV is incorrect?

If your TIV is too low and you have a covered loss, you may only receive a partial payout from your insurance company. This can result in significant financial losses for you. If your TIV is too high and you have a covered loss, you will not receive a payout for the excess amount.

How often should I review my TIV?

It is recommended to review your TIV annually to ensure it reflects the current value of your belongings. As you acquire new items or the value of your existing belongings changes, you should adjust your TIV accordingly to maintain adequate insurance coverage.